Resource Guide: Canada and the CETA (Canada-European Union Comprehensive Economic and Trade Agreement) and what it means for businesses

· by Huzaifa Saeed

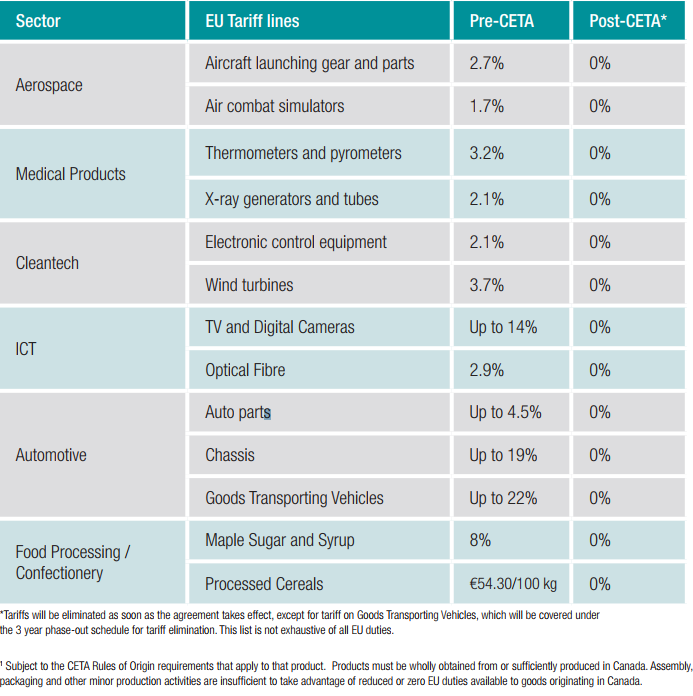

Earlier this Fall, Canada and members of the European Union signed the Canada-European Union Comprehensive Economic and Trade Agreement. The agreement is comprehensive in its coverage and potential new market opportunities for businesses in Canada. For example, before CETA’s entry into force, only 25 percent of EU tariff lines on Canadian goods were duty-free. With CETA, 98 percent of EU tariff lines are now duty-free for Canadian goods. Once CETA is fully implemented, the EU will have eliminated tariffs on 99 percent of its tariff lines. Within the Hamilton context, CETA has several provisions for Agrifood, ICT – Digital Media, Auto Industry and Labour Mobility. For imports into Canada, tariffs are vastly reduced on clothing, vehicles, machinery, electrical equipment, medical devices and chemicals.

In addition to over 510 Million consumers agreement also opens up EU government procurement for Canadian businesses. Lastly, foreign businesses who have a meaningful operation in the territory of Canada (e.g. a Canadian-based manufacturing facility or a Canadian office where services are performed) it can also take advantage of benefits under CETA and access the EU market. A business does not have to be Canadian-owned or controlled to be entitled to the benefits of CETA.

With uncertainty around NAFTA, EU is a natural alternative for many Canadian businesses as well as a market expansion opportunity.

(Source: Invest in Ontario. “A foreign Investor’s Guide to Canada“)

(Source: Invest in Ontario. “A foreign Investor’s Guide to Canada“)

This blog is intended to provide direct links to resources that you can use to investigate the agreement further.

[Disclaimer: Despite reasonable attempts, the Hamilton Chamber does not take responsibility for the accuracy of the content when accessed by the reader. Trade regulations by their very nature are prone to amendments and interpretations. We’ve included sources throughout encourage readers to perform their own due diligence.]

- Overview of the Agreement. (Government of Canada)

- Myths and Realities. (Government of Canada)

- Chapter by Chapter Summaries. (Government of Canada)

- Exporting to Europe, a comprehensive guidebook (Trade Commission of Canada)

- Agrifood Exporter’s Guide to CETA (Alberta Government)

- Tariff Finder and Compare Tool (BDC)

- Selling to Foreign Governments and currently open tenders. (Government of Canada)

- CETA Guidebook for Retailers (Retail Council of Canada)

How to get started

Interested exporters should look at the rules and regulations dealing with their goods at the EU border, such as tariffs and rules-of-origin declarations and breakdowns. They should also look at CETA specific after-border concerns, such as product safety and labelling, while CETA will bring regulatory alignment between the 27+ members, many of them might have country-specific requirements.

There are significant resources available from government and arms-length organizations available to assist businesses throughout the export and import cycle. In addition to advice, they also connect you with grants, loans and participation in trade missions, landing within foreign countries with the support of local trade officials etc. We’ve picked a few:

- BDC, International business development consulting. (BDC is also a member of the Chamber and has local offices, please inquire for a warm introduction).

- CanExport. This Government of Canada program can provide financial assistance to exporters going into a market they have never tried before.

- Trade Commissioners are available in over 161 Cities globally.

- EDC. Offers a variety of insurance, bonding, credit and capital financing programs, linked is their knowledge centre.

- Earlier last week, we attended a CETA workshop organized by the Province of Ontario’s Trade Office. The office offers a variety of advisory programs, trade missions and funding opportunities. Within Ontario Export Services you’ll find details and representatives, a couple of whom even work out of Hamilton. The Chamber will be happy to make a warm introduction.

For more information, please contact: Huzaifa Saeed | Policy & Research Analyst | Hamilton Chamber of Commerce | t: 905-522-1151 ext: 230 | e: h.saeed@hamiltonchamber.ca

Video By

Christoph Benfey

Photography By

Reg Beaudry

Website By

Dunham