Federal Budget 2018: What it means for Businesses in Hamilton

· by Huzaifa Saeed

On February 27th, the Liberal Government released their 2018 Federal Budget. See below for a summary (courtesy of the Canadian Chamber of Commerce) on the impacts it will have on Canadian businesses.

Tax Treatment of Passive Investment Income

Last year’s proposals by the Finance Department had caused significant concerns amongst the business community. After engagement with businesses, the government is moving forward with relatively scaled back policy changes.

New rules for the tax treatment of small business passive income are simpler than previously proposed and will mitigate negative impacts on savings and investment for most small business owners. They will, however, still increase taxes for a small percentage of Canadian Controlled Private Corporations with passive investment income over $50,000.

The government will maintain its commitment to:

- Protect passive investments already made by private corporations, including income earned from those investments

- Establish a $50,000 threshold on passive investment income per year

- Maintain incentives for venture capital and angel investors

o The small business deduction limit will be reduced by $5 for every dollar of passive investment income in excess of the $50,000 threshold. Once passive investment income reaches $150,000, a small company will be subject to the general corporate tax rate. This is a much simpler approach to limiting the tax benefits available to smaller companies than the government proposed last July and does not involve changing refundable taxes or dividend tax rates.

o The budget also proposes to end the tax advantage that larger CCPCs have by paying out lower taxed dividends from active income taxed at the general corporate tax rate and then claiming refunds of taxes paid on their investment income intended to be taxed at the higher tax rate.

Other Tax Measures:

• Eligibility for Mineral Exploration Tax Credit for flow-through share investors is extended for one year.

• 50% declining-balance accelerated depreciation on energy conservation equipment (Class 432. Assets) is extended until the end of 2014.

• Stricter tax treatment of artificial losses using equity-based financial arrangements, share repurchase transactions, at-risk rules for tiered partnerships, health and welfare trusts and foreign affiliates dealing in debt or investment income.

• A “stop-the-clock” rule will be applied to all CRA information requirements and compliance orders, extending the period of assessment to cover any time those orders are contested.

• CRA will be given an additional three years to reassess loss carry-backs involving non-resident, non-arm’s-length corporations.

• GST/HST will apply to management and administrative services provided by the general partner to investment limited partnerships rendered only on or after September 8, 2017.

• Excise taxes on tobacco will be increased and adjusted for inflation annually.

• Rules for the taxation of cannabis are proposed, which will come into effect when cannabis for non-medical purposes becomes available for retail sale.

Spending

Employment Insurance Benefits:

- EI Working while on Claim pilot rules will be made permanent.

- Training funds to assist workers in seasonal industries are increased.

- $1.2 billion over five years to establish a new EI Parental Sharing Benefit.

- Note: In spite of significant investments from the EI fund, total EI benefits are expected to decline because of the budget’s low unemployment forecast.

Skills

- A new Apprenticeship Grant for women and Pre-Apprenticeship Program will

encourage under-represented groups to explore careers in skilled trades. - $2 billion over five years to create a new Aboriginal Skills and Employment

Training Program. - $448.5 million over 5 years to the Youth Employment Strategy. This will support the continued doubling of the number of job placements under the Canada Summer Jobs program in 2019-20 and provide additional resources for a more modernized Youth Employment Strategy in the following years.

Trade and Infrastructure

- $75 million over five years to increase Canada’s diplomatic and trade

presence in Asia. - A Canadian Ombudsman for Responsible Enterprise will be appointed to

ensure Canadian companies operating abroad “exercise leadership in

ethical, social and environmental practices.” - $3.75 billion over 3 years to encourage a stable supply of affordable rental housing across Canada through the Rental Construction Financing Initiative which provides low-interest funding for developers. The funding increase is expected to incentivize an additional 16,000 units.

Innovation

- $1.7 billion over five years to Canada’s granting councils and research institutes.

- $573 million over five years to implement a Digital Infrastructure Strategy.

- $140 million over five years for collaborative projects between business and colleges/polytechnics.

- $540 million over five years to strengthen research and collaboration at the National Research Council.

- $2.8 billion dollars over five years to renew federal research laboratories.

- Simplification and consolidation of business support programs (with additional funding) through an Accelerated Growth Services focusing on the Industrial Research Assistance Program, Strategic Investment Fund, Trade Commissioner Services, and Regional Development Agencies.

- The launch of a new Women Entrepreneurship Strategy with $105 million over five years to regional development agencies to promote women-led businesses.

- $85.3 million over five years to help Canadian companies access and share intellectual property, including the establishment of patent pools, a patent advisory service and the creation of an IP marketplace.

- Establishment of a new electronic procurement platform to simplify and widen the scope of procurement processes.

- $100 million over five years to develop the next generation of rural broadband through funding research and development projects specifically on Low Orbit Satellites.

- $392 million over five years to create a new Centre for Cybersecurity and support its cybersecurity strategy.

Regulatory Reform

A new Regulatory Reform Agenda aimed at supporting innovation and investment, including regulatory reviews, further regulatory cooperation with the United States and a new e-regulation platform to improve consultation and awareness.

Pharmacare

A new Advisory Council will recommend options for moving forward on the implementation of a National Pharmacare Program. While the objective is laudable, the Chamber network feels that will be important that the Council work closely with those businesses that already provide pharmacare-related benefits to Canadians.

Arts & Culture

- $172 million over 5 years and $42.5 million per year ongoing for the Canada Media Fund to provide a stable source of funding to develop Canadian content and support Canadian writers, producers, directors, actors and crews.

- $50 million over 5 years to support local journalism in underserved communities

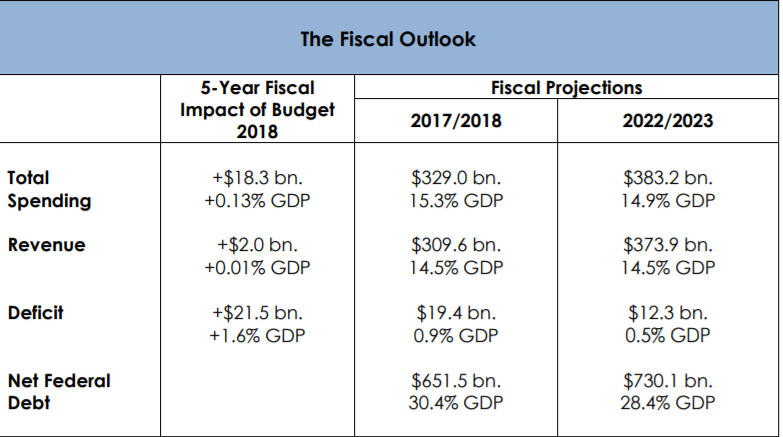

Economic Assumptions within the budget

In Canada:

• Low unemployment rates will persist over the next five years.

• Earnings and confidence will continue to underpin growth, although growth rates will slow.

• Ongoing business investment gains.

• Stronger export performance will offset slower growth in domestic spending.

• Housing market pressures easing.

Internationally:

• Global economy is firming up.

• Global financial conditions remain positive.

• U.S. economy operating at potential.

• European economies strengthening.

• Strong growth in China and emerging economies.

The Risks Ahead:

• Growing protectionism and uncertainty over the outcome of NAFTA negotiations.

• Higher than expected interest rates. A one-percentage point increase in interest rates would increase the federal deficit by about $3 billion over five years.

• High household debt and the risk of a housing market correction.

• An important omission: Loss of tax competitiveness in the face of US tax reforms.

This blog post provides a limited summary of the full Budget document. Members are welcome and encouraged to contact our Policy & Research Analyst for more information on any of the programs mentioned above or to share their concerns and recommendations.

Huzaifa Saeed | Policy & Research Analyst | Hamilton Chamber of Commerce | t: 905-522-1151 ext: 230 | e: h.saeed@hamiltonchamber.ca

Video By

Christoph Benfey

Photography By

Reg Beaudry

Website By

Dunham