5 Minute Business Intelligence by the Canadian Chamber of Commerce: “Home Sweet Home: Is US Housing Set for Growth?”

· by Huzaifa Saeed

The 4th quarter was disappointing for economic growth in the US, but buried in the details is a lot of great news. In fact, the sector that could benefit the most in the coming growth cycle is US housing, because it has reached a turning point due to pent-up demand. This could provide a major boost to US consumer spending and, of course, Canadian business.

After two booming quarters of almost 5% growth, America’s economy seemed to fizzle out at just 2.2% in Q4. However, the underlying components tell a different story. Firstly, the most important part of GDP is consumption because it represents 70% of the US economy. It accelerated to a solid 4.2%, up from 3.2% last quarter. Even better, consumer durables rose 6%, the appliances, electronics and furnishings that people buy when they are feeling wealthier. So if consumers are confident, their incomes are rising and they are spending, then why the weak overall numbers? Firstly, there was a steep cut in federal government spending which fell 7.5%, because of a 16% decline in defense spending. There was also a staggering 10.1% rise in imports, which subtract from US GDP.

To summarize: US GDP growth was lower because although consumers were happily spending, they were also importing like crazy and because the US government was spending less on defence.

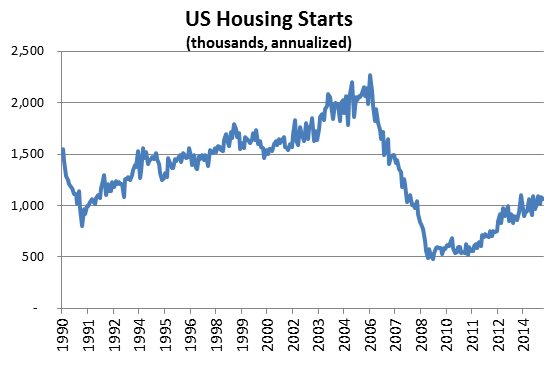

This is generally good news and it sets the stage for further growth in US housing which has been through an unprecedented downturn. Historically, the US has to build 1.4 million homes per year to keep up with household formation, the creation and arrival of new families. For over a decade, the industry massively overproduced homes, and then came the housing collapse. By the end of 2009, home prices were 28% lower than in 2006, existing home sales were 34% lower, and new housing construction starts had plummetted by 74%. Not only was there an oversupply of homes, which peaked at over 6 million. The economic stress of the downturn was massively altering behaviour, as people delayed getting married and moving in together. Household formation dropped from over 1.8 million in 2006 to 500 thousand in 2010, as the proportion of 18- 34 year olds who lived with their parents rose from 24% to 32%. But now the tables have turned with incomes rising and the job market in great shape, household formation rose to 2 million in January, its highest level in 5 years. The inventory of US homes has fallen to under 1.9 million.

The Canadian Chamber of Commerce is forecasting that housing starts in the US will rise almost 20% to 1.2 million in 2015. This is great news for the lumber industry, which has been Canada’s fastest growing export sector for the period from 2012 to 2014. This is also good news for producers of a wide variety of consumer goods. Every homeowner knows that a home purchase is only the beginning of a spending spree. The home has to be decorated and filled with costly furniture. This means a positive outlook for the lumber industry, for exporters of consumer goods, and for US parents who want their kids to move out.

For more information, please contact :

Hendrik Brakel

Senior Director, Economic, Financial & Tax Policy

613.238.4000 (284) | hbrakel@chamber.ca

Video By

Christoph Benfey

Photography By

Reg Beaudry

Website By

Dunham